Last updated on May 29, 2022

Depending on where you grew up, the schools you went to and the family and friends you had, the racial wealth gap may be something of an invisible construct that has an extraordinary significance on your life. In recognition of National Financial Literacy Month, the Office of Diversity, Equity and Inclusion is focusing on societal issues impacting individual and group-based financial wellness.

The What

The racial wealth gap is an intentionally curated system designed centuries ago that began “when European settlers stripped Natives of their lands and used Africans as enslaved labor, preventing them from fully participating in the economy and reaping the fruits of their work” (The Harvard Gazette, para. 5).

Even with the abolition of institutional slavery 1865, various civil rights acts spanning the 19th and 20th centuries, and enacting nationwide anti-discriminatory voting rights in 1965, which subsequently granted Black Americans full citizenship, Jim Crow laws virtually ensured that Black and Indigenous people, respectively, could not accumulate or pass on wealth within their families. This was done by effectively enforcing inequities, such as redlining housing by zip codes.

This brief video summarizes the role the U.S. government played in erecting racially exclusive suburbia.

In this way, racial covenants became widely popular throughout areas of the nation. Learn more about the pervasive clustering, steering and intentional race-based mapping practices saturating the U.S. housing market. This systemic and racial impediment extended to not only the ability to financially make, borrow, and/or accumulate financial resources needed to create wealth, but such discrimination extended to every aspect of life – employment, schooling, business, healthcare, the likelihood of exposure to the criminal justice system and beyond.

The Why

Wealth gaps impact every member of society with disparate impact felt by members holding multiple marginalized and historically under-resourced identities. Here are some realities associated with the racial wealth gap:

- The zip code you were born or live in: According to Talk Poverty, one’s ability to obtain the American Dream is largely dictated by the zip code they were either born in or live in currently. Nearly 13.8 million Americans currently live in neighborhoods that are high-poverty, low-opportunity, which means that more than 40% of the residents are poor.

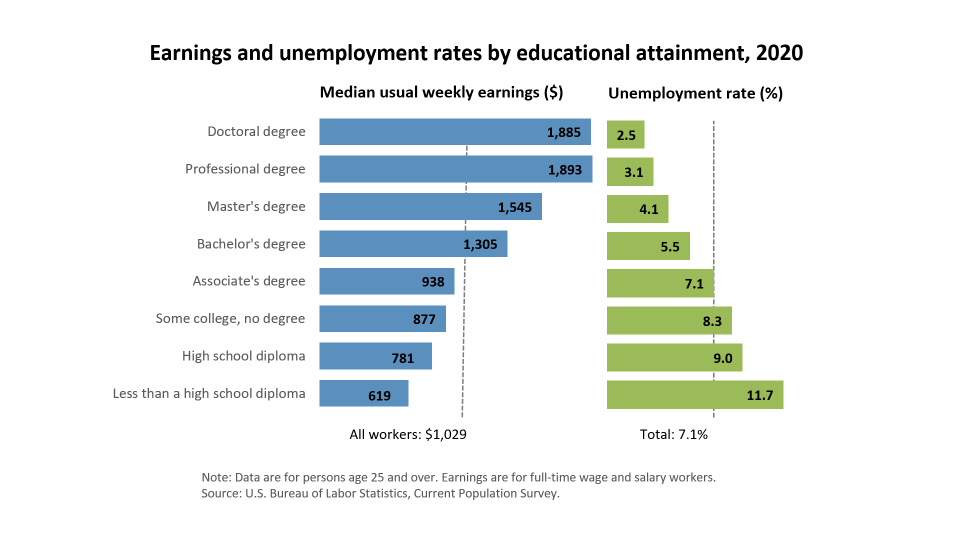

Access to quality education: For low-income families, if they had an increase in annual earnings of 31%, “they are more likely to attend college and less likely to become single parents.” Other reports show that the higher the academic attainment, the higher the median weekly earnings, and the lower the unemployment rate for full-time and salary workers over the age of 25.

Access to quality education: For low-income families, if they had an increase in annual earnings of 31%, “they are more likely to attend college and less likely to become single parents.” Other reports show that the higher the academic attainment, the higher the median weekly earnings, and the lower the unemployment rate for full-time and salary workers over the age of 25.- Employment and Inequities in Pay: There continues to be an inequity in pay based on race when comparing minority groups to the White population. More specifically, for every $1 earned by a White male, Black men earned 87 cents, Hispanic men earned 91 cents. Asian men typically earned $1.15, the most of all ethnic groups. When race and gender is considered together for full-time work, women were paid 80 cents, Black women were paid 63 cents and Hispanic women were paid 59 in comparison to every $1 earned by a White male.

- Generational wealth: According to the 2019 Survey of Consumer Finances (SCF), the average White family has eight times the wealth (mean $983,400) of the average Black family (mean $142,000) and five times the wealth of the typical Hispanic family (mean $165,000). These disparities are nothing new as they are longstanding and sustainable over centuries. A major contributing factor to the wealth-holding of White families is that they are 30% more likely to receive an inheritance or gift (such as support in the form of a down payment for a house) vs. 10% of Black people, 7% of Hispanic persons and 18% of other families.

These are just a few of the glaring contributions to the racial wealth gap that not only impact the way we live today, but also how we shape our future.

The How: Closing the Gap

The total racial wealth gap is estimated at approximately $10.14 trillion. Closing the gap requires a multifaceted and systematic approach that is driven by public policy decisions that eliminate disparities in homeownership, access to education, income inequalities, as well as an increase in financial literacy, education and understanding, particularly among people of color.

Fundamentally, wealth is one’s financial ability to prepare for their future effectively and comfortably. Reducing barriers and inequities while increasing equitable access for all, regardless of race or ethnicity, is a necessity.